Introduction

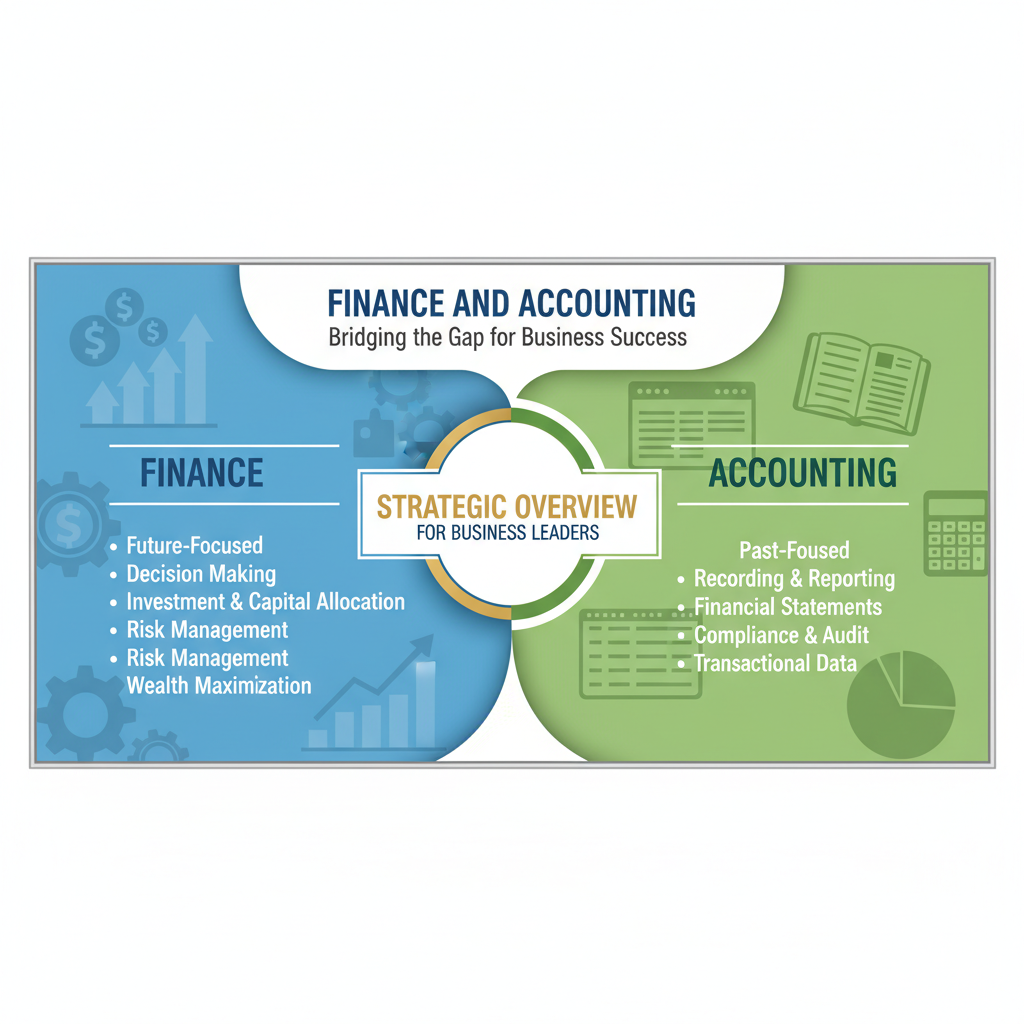

In the intricate ecosystem of a modern enterprise, two functions stand as the primary stewards of fiscal health: finance and accounting. While often used interchangeably, they represent distinct disciplines with unique philosophies and strategic contributions. For business leaders, understanding the nuanced interplay between finance and accounting is not an academic exercise. Instead, it is a critical component of effective governance and sustainable growth. This overview delves into the core of finance vs accounting, not as a rivalry, but as a necessary duality. We will dissect their respective roles and illustrate why leveraging both is essential for navigating the contemporary business landscape.

The Foundation: Accounting as the Historian

Accounting is the bedrock of all financial intelligence. It is a systematic, rules-based discipline focused on precision and compliance. Think of the accounting function as the organization’s historian and scorekeeper.

Its primary deliverables are the foundational statements: the Income Statement, the Balance Sheet, and the Cash Flow Statement. These documents provide a standardized, verifiable record of what has already happened. Consequently, accountants ensure that every transaction is recorded according to established standards like GAAP or IFRS. Their work is characterized by precision, a backward-looking focus, and a mandate for credibility.

Without this rigorous work, there would be no trustworthy data for future-facing analysis. Therefore, the debate of finance vs accounting begins by recognizing that accounting provides the essential raw material of truth.

The Architecture: Finance as the Futurist

If accounting is the historian, finance is the architect. Finance is a forward-looking discipline concerned with value creation and managing future growth. It takes historical data from accountants and uses it to model, forecast, and inform strategy.

Finance professionals analyze accounting records to answer critical questions. For instance, should we enter a new market? Is this capital project worth the investment? Their work is inherently analytical, involving:

- Forecasting and Modelling: Projecting future revenues, expenses, and cash flows.

- Capital Budgeting: Evaluating long-term investment opportunities.

- Risk Management: Identifying and mitigating future financial risks.

- Strategic Funding: Deciding how to best raise capital.

The core of the finance vs accounting distinction lies in this temporal orientation. Finance shapes what will be, while accounting records what has been.

The Strategic Synergy: An Integrated Powerhouse

Successful businesses do not choose between finance vs accounting; they recognize the two as an integrated, symbiotic powerhouse. The relationship is one of profound interdependence.

The accounting team produces accurate financial statements. Subsequently, the finance team leverages this data to perform ratio analysis, create budgets, and assess the company’s financial health. For example, historical sales data from accounting is essential for a sales forecast in finance.

When these functions operate in silos, the organization suffers. Strategy without accurate data is guesswork. Conversely, meticulous record-keeping without strategic application is a missed opportunity. Thus, modern leadership must foster a culture where the clarity of accounting informs the vision of finance.

Fostering Collaboration for Strategic Advantage

To truly resolve the finance vs accounting dynamic, leaders must actively foster collaboration. This requires strategic investment in both functions and ensuring they have a seat at the leadership table. The leader’s role is to champion both departments and demand integration between them. For example, encourage finance to challenge assumptions with accounting’s data. Simultaneously, help accounting understand the strategic needs of the finance team. Ultimately, by asking the right questions that draw from both disciplines, a leader can decode complex information and capitalize on opportunities with greater agility.

Implications for Modern Business Leadership

For a CEO or executive, the practical takeaway is clear. Mastering the interplay of finance vs accounting is a relationship to be mastered for long-term competitive advantage. Leaders must use the combined output to ask probing, forward-looking questions. By appreciating the distinct yet complementary nature of these roles, a leader can steer their organization with greater confidence and insight.

Frequently Asked Questions (FAQ)

Q1: Can’t a strong accountant also handle all the finance functions?

While a skilled accountant understands financial data, the core mindset differs. Accounting emphasizes compliance and historical recording, while finance focuses on analysis and strategic risk-taking. In a small business, one person may wear both hats, but as a company grows, the roles naturally specialize.

Q2: Which function is more important for a startup company?

Both are critically important from day one. Solid accounting is non-negotiable for managing cash burn and taxes. Simultaneously, financial forecasting and fundraising are essential for survival and growth. Consequently, the startup environment demands a tight, iterative loop between the two.

Q3: How does the “finance vs accounting” dynamic impact my role as a non-financial manager?

Understanding the distinction allows you to interact more effectively. You go to accounting for historical reports on your department’s budget. Conversely, you go to finance for help building a business case for a new project.

Q4: Is the CFO an accountant or a financier?

The CFO is primarily a financier and strategist. While understanding accounting principles is foundational, the CFO’s primary responsibility is to steer the company’s future financial strategy and make high-stakes decisions.

Q5: With the rise of AI and automation, which field is more at risk?

Automation is primarily impacting repetitive tasks within accounting, elevating the role towards analysis. In finance, AI enhances modeling, but strategic interpretation remains a human function. Therefore, both fields are evolving, not becoming obsolete.